Forex trading is widely used all over the world. In other words, you can relate to this as the biggest business across the globe. If you are new to Forex trading, let's get some insight into the world of foreign exchange trading. New York owns one of the world's biggest stock exchanges, and they trade at least $22.3 billion daily. However, in Forex trading, companies exchange at least 5 trillion dollars daily.

It's not possible to understand Forex trading by only reading the definition. It has a very high risk, and I will not recommend investing big if you are a beginner. If you start Forex trading after the proper research and with the right strategy, the probability of becoming successful is high. So in this guide, we will give you brief information about Forex trading so that you can understand and get proper knowledge of it.

What is Forex Trading?

The Forex exchange market or FX market is the biggest financial market that works in a proper network. In simple words, it's the conversion of one currency to another. The sellers and buyers are both involved in this market. Different companies use different currencies from all over the world to buy goods. To buy goods, you will require local currencies in higher amounts. The exchange of currency causes a change in exchange rates.

The Forex market is not an old market like the stock market, but there is no doubt that we humans are converting currency for financial benefits. However, as per the modern Forex market history, more major currencies started to be converted from one to another in 1971 after Bretton Woods' accord. We know that the values of different currencies vary, and it becomes one of the major reasons for the requirements of trading and foreign exchange services. Apart from Forex trading and the stock market, people are moving to cryptocurrency like Bitcoin as it offers amazing profits but with risks.

How does the Exchange Rate Work?

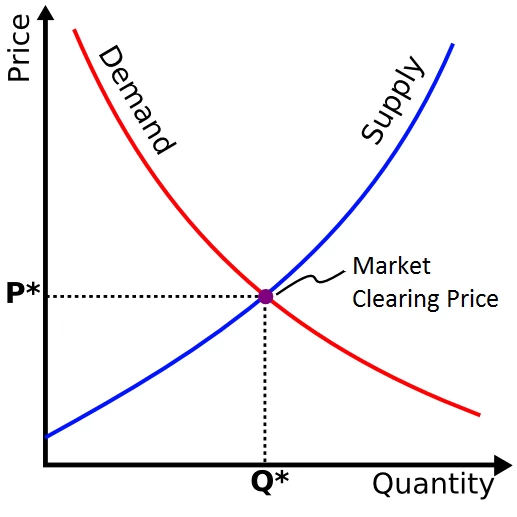

During the currency exchange, every currency has a certain rate. The law of supply and demand can determine the price. If a particular currency has a high demand in the market, it will automatically increase that currency. It will also affect the exchange rate of that specific currency.

For example, let's suppose you live in India and want to spend your holidays in the US. You have to exchange your Indian rupees in US dollars to buy something from the local store. When you come back to your home country, you need Indian rupees again. If the dollar rates are increased during the exchange, you will get a profit, and that's exactly how it works.

How do Currency Markets Work?

Compared with commodities or shares, Forex trading doesn't work on exchanging, but it occurs directly between two parties on the over-the-counter (OTC) market. As per the little information about the Forex market, it is made up of different currencies worldwide, and some factors affect pricing, so it becomes hard to predict exchange rates. Still, similar to financial markets, Forest is majorly affected by the laws of demand and supply. So there are three types of Forex markets:

- Forex spot market: It is a currency pair's physical exchange that takes place on the exact point at which an operation gets settled, i.e., on the spot or within a specific short period.

- Forex forward market: In this market, a contract establishes for buying or selling a specific amount of the currency at the particular price required to get settled on a definite date in the future.

- Forex futures market: In this type of market, a contract is agreed upon for buying or selling a specific amount of a specific currency on a set price and fixed date in the future. Compared with the forward market, the Forex future market is legally binding.

How does Forex Trading Work?

There are various ways that you can use for trading Forex, but all of these ways work similarly by buying one currency and selling another one. In simple words, Forex trading has traders that attempt to obtain profits by selling or buying currencies through actively speculating on the specific direction currencies are expected to take in the future.

Traditionally, many Forex transactions are made through Forex, but by developing online trading, you can benefit from the Forex price movement by derivatives such as CFD trading. So CFDs are nothing but leveraged products that offer a way to open a position at just a fraction of the trade’s full value.

Apart from non-leveraged products, you don’t have to obtain ownership of a specific asset, but you can obtain a position on the predictions of the current market. However, leveraged products can easily increase profits, but they can also increase the chances of loss if the market changes against your predictions.

Factors of Forex Market

As we have mentioned earlier, Forex markets are based on currencies worldwide. These currencies can create exchange rate predictions harder because various factors can combine in the price movements. Like most financial markets, Forest is also driven by the force of supplies and demands, so it is essential to understand the influences that can drive price fluctuations. So here is the list of factors that works in the Forex markets:

News Reports

All commercial banks or investors need to put their capital in the economies which have a powerful outlook. Hence, in case positive news spreads in the markets regarding a specific region, then it can encourage investment and improve the demand for that particular region’s currency.

Economic Data

It is integral to a specific price movement of that currency for two reasons, and they are:

- It provides an indication of how well a particular economy is performing.

- It provides insight into the next steps of a central bank.

Market Sentiment

It is a reaction to the news that plays an important role in driving the currency price. In case a trader believes that currencies are headed in a specific direction and trade respectively, it can influence others to pursue the suit, raising or reducing demand.

Credit Ratings

All investors try to maximize the return they obtain from marks and minimize risks. Alongside interest rates and economic data, they can also look for credit rates while deciding the investments.

Risks in Forex Trading

There is no doubt that trading currencies are full of risk and complexities, and Forex trading is unregulated in some places of the world. There is an interbank market that is created by banks trading with each other globally. So these banks also have or find sovereign risk and credit risk, and they have set internal processes for keeping themselves safe. The market is created by different banks participating and providing offers or bids for the currencies, so the market price mechanism is completely based on demand and supply.

FX Market and Interest Rates

If we talk about Forex trading, the interest rate is one of the major parts of this business because every local currency has real bank interest rates. There are certain factors to consider before investing in Forex trading.

- What's the current interest rate of that specific local currency in which you want to invest?

- How the central bank rate can affect the currencies?

- Main strategies about the Forex trading interest rate?

Is it Beneficial to Invest in Forex Trading?

There are certain factors on which success and failure depend. It is possible that you can get double the profit. It's also possible that you can get some loss. So, there's no direct yes or no answer. However, if you are very serious about Forex trading and did all the necessary research, it will pay off well if you follow a solid plan. Before finishing, we would like to highlight some points:

- Before starting Forex trading, first of all, understand the exchange market. Benefit and loss are two sides of the same coin. Understand the basic dynamics, do some research, read related books, and attend some seminars. That way, there's a high chance to get profit and a lower risk rate.

- Secondly, there's not even a single strategy in the market that will benefit you every time. Collect the set of trading strategies and study the situations and profits and losses combined with them.

If you're looking to host your very own Forex trading site, look no further. We provide VPS optimized for Forex trading without breaking the bank.

Pros and Cons of Forex Trading

Pros

- The Forex market is one of the widest markets in terms of daily activities and trading worldwide. Hence Forex markets offer the most liquidity, and it is easy to enter & exit a specific position in any major currency.

- The Forex market remains open 24 hours a day for five days every week, starting every day in Australia and ending up in New York. As we have mentioned earlier, Forex trading has major centers such as Sydney, Hong Kong, Paris, London, Tokyo, Frankfurt, and New york.

Cons

- All banks, brokers, and dealers have the liberty to have a high amount of leverage in Forex markets that all traders can easily control the larger positions with a relatively lower money. So leverage is in the approximate range of the ratio 100:1, which is higher, but it is not uncommon in Forex. A trader has to understand every leverage with the risks that leverage introduces in a specific account. All extreme amounts of leverage have managed in various dealers becoming broken unexpectedly.

- You need to understand the economic indicators and fundamentals to trade currencies productively. As a currency trader, you need to understand the economies of multiple countries and inter-connectedness to follow all fundamentals that manage the currency value.

Conclusion

So it was the complete information upon Forex trading and all of the required information to understand this specific market. As we have mentioned earlier, it is not as old as the stock market, and it has both profit and loss, so make sure you go into this field with a complete mindset. In case you find our guide informative, please do check out our official website as we offer multiple services at lower prices.

I'm fascinated by the IT world and how the 1's and 0's work. While I venture into the world of Technology, I try to share what I know in the simplest way with you. Not a fan of coffee, a travel addict, and a self-accredited 'master chef'.